Increases in Flood Insurance Inevitable – Facts about Charleston, SC Flood Insurance

The Latest News on Flood Insurance Changes

Luckily for us, Senator Tim Scott has been on our side pushing for FEMA to look at our flood plains and rezone Charleston SC’s over 20 yr old flood levels. After 2015’s historic devastating flooding that wreaked havoc over almost the entire state, not just the low-country, but including the midlands it is about time the FEMA flood maps be reconfigured. The Senate and House have passed (March 2014) a bill to delay premium hikes for years on hundreds of thousands of homeowners who buy flood insurance from the federal government. Important points are:

for years on hundreds of thousands of homeowners who buy flood insurance from the federal government. Important points are:

The House bill caps annual price increases in order to prevent sticker shock, a move that will slow the pace of the authorized transition to actuarially sound policies. It also reinstates grandfathering of buildings built to a previous code standard. The new legislation would delay for up to four years huge premium increases that are supposed to phase in next year and beyond under new and updated government flood maps. It also would allow homeowners to pass below-cost policies on to people who buy their homes. The 67-32 vote reflects widespread concern about changes enacted two years ago to shore up the program’s finances. The changes are producing sky-high insurance rates that are unaffordable for many homeowners in flood-prone areas like Charleston whose insurance has historically been subsidized by the government and other policyholders.

Homeowners who upgrade to a new policy will be allowed to do so without being assigned to a new risk category. Homeowners who overpaid under the new rules will be reimbursed.

One proposal, by Sen. Pat Toomey, R-Pa., would proceed with the premium increases but cap them on most properties – including homes being sold – at 25 percent per year until the premium reflects the true flood risk. It faces almost certain rejection, though Toomey said it lines up with what the Obama administration wants. The administration said in a statement it “strongly supports a phased transition to actuarially sound flood insurance rates.”

The legislation is a win for coastal state Democrats like Sens. Mary Landrieu of Louisiana, Bill Nelson of Florida, and Bob Menendez of New Jersey, who have formed an unstoppable coalition with Republicans representing coastal areas and the Mississippi basin like Sen. John Hoeven of North Dakota.

The bill, however, contains no relief in the offing for 1.7 million owners of second homes, who are not covered by the Senate bill and who face annual 25 percent increases – provided they owned their home before Congress overhauled the program in 2012. They say the premium hikes threaten the viability of older beachfront towns.

(live5news.com)

CHECK YOUR HOME’S FLOOD ZONE LEVELS

As of March 20th 2015 the latest changes in flood insurance rates:

We all know the chances of a flood are usually slim, but if it does happen the effects can be devastating. So making sure you are covered correctly will help ease this possibility. As much as 75% or more of the low-country is considered in a flood zone or possibility of flooding. More than 14,000 homes in the Charleston area will be affected by recent changes to the new FEMA flood program. FEMA is changing the flood lines, and expect that the new changes will cost you money if you are buying a home in Charleston. The biggest thing to consider is to avoid buying a home built prior to 1974 and to be even MORE careful don’t consider buying a home built before 1995. As there were building codes that were implemented in the 90’s to combat the threat of floods and insurance providers consider this. In most cases, the new rules for flood insurance will require almost every house being purchased or insured to have a current up-to-date elevation certificate done.

Depending on what is on the elevation certificate about where or how your home is situated as it pertains to the flood plain will determine your cost for flood insurance. Some other factors that will dictate your cost for flood insurance are the way the foundation was built, age of home, the height of the home, and the number of foundation vents, and their size (sq inches). There are a lot of factors that go into calculating your insurance costs so the best thing to do is to contact a licensed local agent to answer your questions. Increases in flood insurance premiums having negative effects on listing your home for sale. MORE HERE –>

UPDATE: 1/16/14: You may hear about a flood insurance premium delay in the Omnibus Appropriations Bill that passed Congress this week – this delay is for implementing future premium increases on grandfathered (post-FIRM) properties only for the next 9 months. This does not address the devastating subsidized (pre-FIRM) point of sale premium increases hurting our real estate market. The Omnibus Appropriations Bill prohibits funding for implementing future premium increases on “grandfathered properties” only. It does not include a delay for the home buyers who have already seen rate increases over the past year.

*The good news – the U.S. Senate plans to vote on legislation that would create a 4-year “time out” for both impacted home buyers and future increases on “grandfathered” properties. The Senate Majority Leader has promised the sponsors a vote on S. 1846 Homeowner Flood Insurance Affordability Act which would delay any increases for 4 years; they are currently negotiating the number of amendments and amount of debate time. The bill is expected to come up the week of January 27 if not as soon as today. Both South Carolina senators, Tim Scott and Lindsey Graham, are co-sponsors of S.1846. If it passes the U.S. Senate this month, it would still have to clear the U.S. House of Representatives and that is a high hurdle to clear — although Congressman Mark Sanford supports the bill.

SUBSIDIZED PROPERTIES

This includes Pre-FIRM properties below Base Flood Elevation (BFE). Pre-FIRM in Charleston County means start of construction or substantial improvement was before 1975. To determine the pre-FIRM date for every city and county in South Carolina, click here.

Primary residences:

Beginning when the policy renews starting October 1, 2013, rates will move to full actuarial rates at the time the property sells (this will apply retroactively to all properties sold since July 6, 2012).

Non-primary residences, commercial properties and repetitive loss properties:

Beginning October 1, 2013 rates move to actuarial rates and premiums will increase 25% per year. The only way to know your full actuarial rate and to find your maximum premium is to have a current elevation certificate. Access FEMA’s 2013 Rate Schedule for second/vacation homes here (which includes the first 25% step increase)

Note: Rates are per $100 of coverage.

GRANDFATHERED PROPERTIES

This includes post-FIRM properties that were built at Base Flood Elevation, but BFE has since been raised since construction OR the property was mapped into a different flood zone.

Rates will be phased out and be brought to new actuarial rates only after the new flood rate maps are adopted. This is expected to be completed in South Carolina in late 2014 or early 2015.

ALL OTHER PROPERTIES REQUIRING FLOOD INSURANCE

All other properties will see rate increases of at least 5%, but possibly higher (in the 20% range), but each property is different.

(Source: http://www.charlestonrealtors.com/) Advise your clients to speak to an insurance agent before buying.

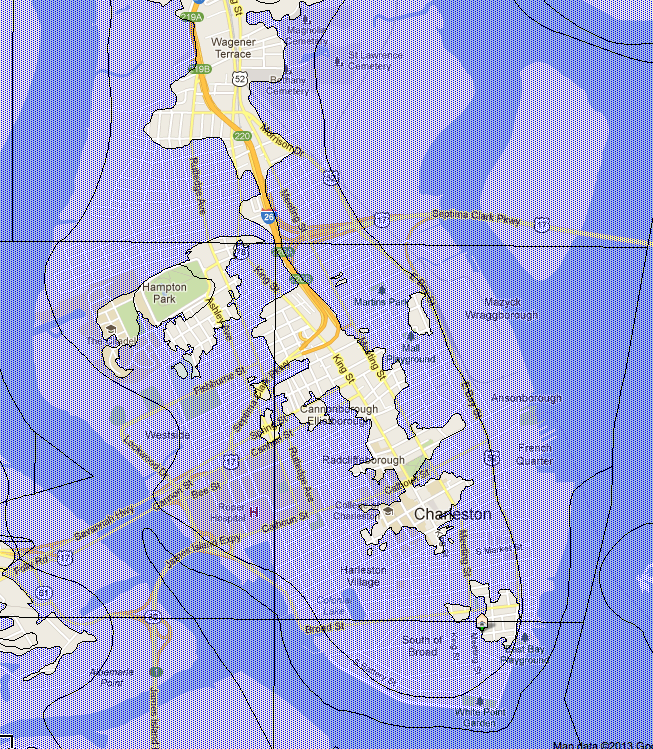

Downtown Charleston South Carolina Flood Prone Areas

(area in white is the worst)

If you don’t carry adequate flood insurance and you have a mortgage your lender will give you what is called FORCED PLACED insurance. Which is usually much more expensive then you would find on your own.

Secondly, flood insurance is flood insurance. There is NO shopping around for flood insurance. FEMA regulates flood insurance and its costs. Agents simply are the distributors of the policies. However, your insurance could vary in cost IF and only if the agent providing you the flood insurance quote makes a mistake in inputting the information therefore, affecting the rating adversely.

–In Charleston County, FEMA said all homes built before April 1971 pre-date the first flood map. In Dorchester County, the date is January 1982, and in Berkeley County it’s September 1983.

Homes built after flood maps were adopted will not see as much impact from the NFIP changes, but they could be affected by the new flood maps FEMA is developing for the entire United States, the agency said.

On Oct. 1, when parts of the new law kicked in, flood policies increased an average of 10 percent. Under the changes, subsidies are being removed from second homes, rentals and businesses, as well as dwellings that have had repeated flood losses. Homes sold in pre-FIRM areas are automatically required to have the much more expensive insurance that reflects the “true risk” of flooding. (Source – Post & Courier)-

Senior officials for NFIP said they are $24 Billion in debt following many recent disastrous storms in recent years as the costs and consequences of flooding continue to increase. “For decades the program subsidized rates and has made insurance available but didn’t reflect the true risk of flooding, and just like our health insurance system, artificially low rates and discounts are no longer sustainable”.

Rate changes are likely to affect owners of subsidized pre-FIRM non-primary residences, business properties, and properties that have experienced sever repetitive flood losses. Owners of pre-FIRM condos and multi-family units will also see their rates gradually increase. Owners of pre-FIRM primary residences will retain their subsidies unless the policy lapses; it suffers a severe, repeated loss’ or it’s sold to a new owner which is retro active to July 6th, 2012 when the legislation was enacted.

As FEMA improves its mapping technology and draws more accurate flood maps, some homes may now be located in a flood zone, or higher risk area, where the flood insurance is more expensive. Also, some insurance agents may adjust rates to correct previous mistakes made about the home’s features when they are re-evaluating a policy at renewal.

Below are the lists of things needed to get adequate flood insurance.

1.) An up to date, signed survey, with an elevation certification from a licensed professional (engineer, surveyor, architect) on the most recent FEMA form dated as of Jan 1, 2007. To see if your home is in a flood zone click HERE.

2.) 2 dated photographs of the home both front and back within 90 days of requesting coverage.

Definitions of FEMA Flood Zone Designations : Charleston SC Flood Zones

ZONE | DESCRIPTION |

B, C, and X | Areas outside the 1-percent annual chance floodplain, areas of 1% annual chance sheet flow flooding where average depths are less than 1 foot, areas of 1% annual chance stream flooding where the contributing drainage area is less than 1 square mile, or areas protected from the 1% annual chance flood by levees. No Base Flood Elevations or depths are shown within this zone. Insurance purchase is NOT required in these zones. |

ZONE | DESCRIPTION |

A | Areas with a 1% annual chance of flooding and a 26% chance of flooding over the life of a 30-year mortgage. Because detailed analyses are not performed for such areas; no depths or base flood elevations are shown within these zones. |

AE, A1-A30 | Areas with a 1% annual chance of flooding and a 26% chance of flooding over the life of a 30-year mortgage. In most instances, base flood elevations derived from detailed analyses are shown at selected intervals within these zones. |

AH | Areas with a 1% annual chance of shallow flooding, usually in the form of a pond, with an average depth ranging from 1 to 3 feet. These areas have a 26% chance of flooding over the life of a 30-year mortgage. Base flood elevations derived from detailed analyses are shown at selected intervals within these zones. |

AO | River or stream flood hazard areas, and areas with a 1% or greater chance of shallow flooding each year, usually in the form of sheet flow, with an average depth ranging from 1 to 3 feet. These areas have a 26% chance of flooding over the life of a 30-year mortgage. Average flood depths derived from detailed analyses are shown within these zones. |

AR | Areas with a temporarily increased flood risk due to the building or restoration of a flood control system (such as a levee or a dam). Mandatory flood insurance purchase requirements will apply, but rates will not exceed the rates for unnumbered A zones if the structure is built or restored in compliance with Zone AR floodplain management regulations. |

A99 | Areas with a 1% annual chance of flooding that will be protected by a Federal flood control system where construction has reached specified legal requirements. No depths or base flood elevations are shown within these zones. |

| High Risk – Coastal Areas | ||||||

| In communities that participate in the NFIP, mandatory flood insurance purchase requirements apply to all of these zones: | ||||||

|

So what’s this mean for buyers and lookers? The obvious answer is rising prices which has been the case for months now. Secondly, according to National Assoc. Realtors 60% of all sellers last year offered concessions to attract buyers. With it being and strengthening into a full on seller’s market you will likely see this incentives quickly disappear.

So what’s this mean for buyers and lookers? The obvious answer is rising prices which has been the case for months now. Secondly, according to National Assoc. Realtors 60% of all sellers last year offered concessions to attract buyers. With it being and strengthening into a full on seller’s market you will likely see this incentives quickly disappear. Buy a short sale can be a very exciting thing when you are someone who is price conscience because you feel you are getting a deal, but WAIT. Buying a Charleston, SC short sale or anywhere is not an easy process and you must be patient and be prepared to deal with a lot of annoying bumps in the road. When buying a distressed

Buy a short sale can be a very exciting thing when you are someone who is price conscience because you feel you are getting a deal, but WAIT. Buying a Charleston, SC short sale or anywhere is not an easy process and you must be patient and be prepared to deal with a lot of annoying bumps in the road. When buying a distressed

You must be logged in to post a comment.